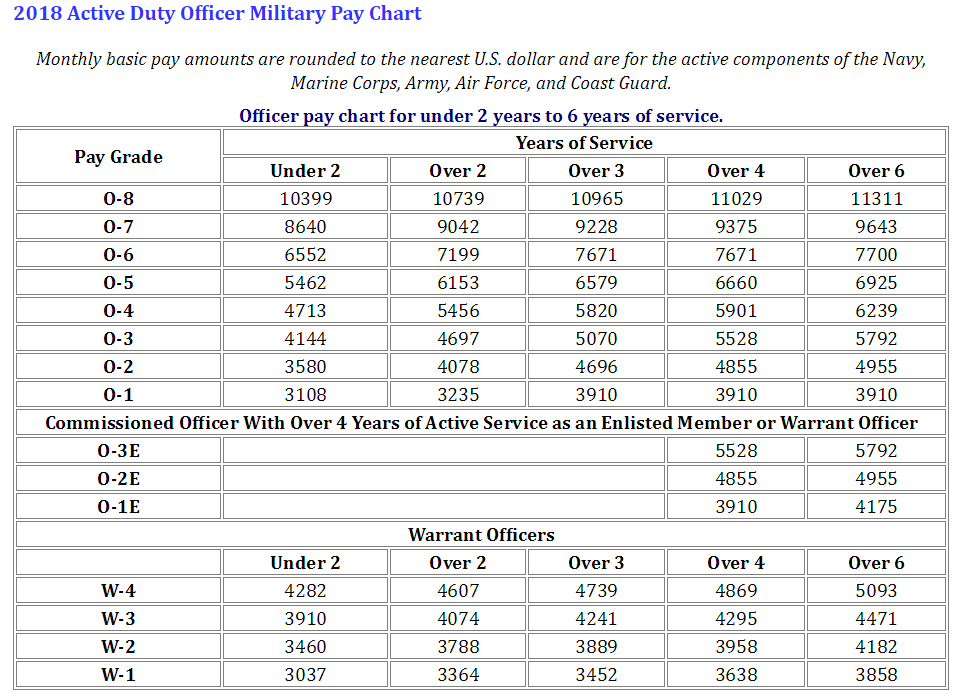

The 2017 BAS for officers is: $253.63 per month (non-taxable). The BAS is the same rate for the entire year, one rate for officers and one rate for enlisted. Nonetheless, here is the site which matches what I get for BAS. gov site actually had the wrong number (it wasn’t updated since 2014). Every time I search for an official site for this I always find a different site. The military doesn’t control how you spend this money, so you could technically spend $100 on rice and beans for the entire month and pocket the rest, but this is the allowance you are given. The military pays us a standard rate per month for food. The 2017 base pay for an O-1, 2 or less TIS is: $3,034.80 per month (taxable). Prior enlisted officers (over three or four years TIS, I can’t remember), can qualify for O-1E which is a slightly higher rate. The day you commission you will be separated as a Staff Sergeant and commissioned as a Second Lieutenant, O-1. The day you start OTS you will be a Staff Sergeant, which is pay grade E-5. If you are a non-prior at OTS, I assume your TIS starts the day you begin OTS, so your TIS will be “2 or less.” Next, find your pay grade and you will see your “Base Pay.” To find your base pay, find your Time in Service (TIS) in Years at the top of the chart. H ere is a link to the DFAS site which has all of the military pay tables from 1949 to the present.

My LES is composed of the following entitlements:īase Pay is a publicly available number anyone can reference on the web. This is a huge unseen benefit of being in the military. The main difference between the two is base pay is taxable, allowances are not. There are two main types of entitlements, Base Pay and Allowances. Your entitlements are what the military owes or pays you. Here is a breakdown of each: Entitlements The LES is divided into three main financial sections Entitlements, Deductions, Allotments, and Summary.

#Air force enlisted pay how to#

The first one you are likely concerned with is your military pay stub, which we call a Leave and Earnings Statement (LES.) There are a lot of other sites out there which explain how to view your LES, so I am just going to focus on how you can use the internet to calculate your military pay once you commission.

#Air force enlisted pay download#

You can use myPay to manage almost anything finance related (e.g., download your W-2 tax forms, change how you claim on your W-4, set up allotments which are automatic transfers from your paycheck to separate bank accounts, or view your pay stubs.)

Once you join the Air Force someone will set you up with a “myPay” account page on the DFAS web site. Everyone in the Air Force, and the DoD for that matter, is paid by the Defense Finance and Accounting Service (DFAS).

0 kommentar(er)

0 kommentar(er)